Technical analysis software plays a vital role in the Indian stock market, offering traders sophisticated tools to analyze market data and make informed decisions. Here’s a comprehensive look at how Technical Analysis Software Functions in the Indian Stock Market these software solutions function:

- Data Aggregation and Integration: Technical analysis software begins by aggregating vast amounts of historical market data from various sources, including stock exchanges like the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), as well as data providers. This data encompasses a range of information, including price data (open, high, low, close), trading volumes, and other relevant metrics.

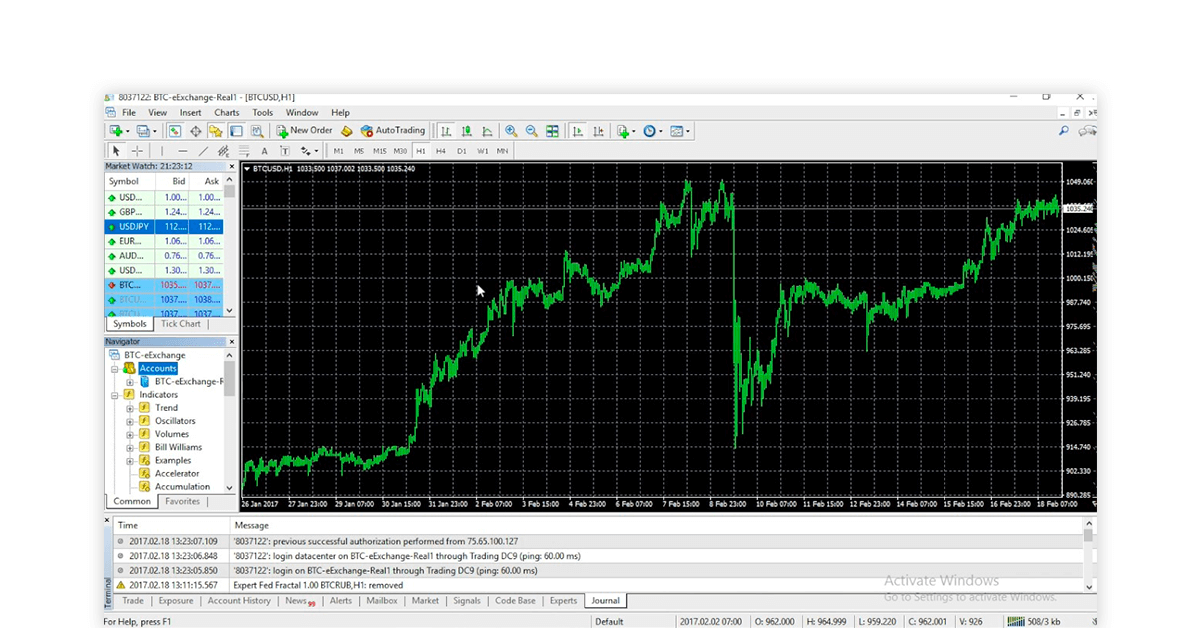

- Charting and Visualization: One of the primary features of technical analysis software is its ability to visualize market data through charts. These platforms offer a variety of chart types, with candlestick charts being particularly popular due to their ability to convey detailed price information. Traders can customize chart parameters such as timeframes (intraday, daily, weekly, monthly) and overlay multiple indicators for comprehensive analysis.

- Technical Indicators and Analysis Tools: Technical analysis software provides an extensive array of technical indicators and analysis tools to assist traders in interpreting market trends and identifying potential trading opportunities. These indicators include moving averages, MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), Fibonacci retracements, and many others. Traders can apply these indicators to historical price data to spot patterns and trends that may indicate future price movements.

- Pattern Recognition and Detection: Advanced technical analysis software incorporates pattern recognition algorithms capable of automatically identifying common chart patterns such as head and shoulders, triangles, flags, and channels. By recognizing these patterns, traders gain insights into potential market reversals or continuation patterns, allowing for more informed decision-making.

- Algorithmic Trading Capabilities: Many technical analysis platforms offer algorithmic trading capabilities, enabling traders to automate their trading strategies based on predefined rules and criteria. These algorithms can execute trades automatically when certain technical conditions are met, allowing for rapid response to market developments without constant manual intervention.

- Backtesting and Optimization: Traders can backtest their trading strategies using historical market data to assess their performance under various market conditions. This feature enables traders to refine and optimize their strategies by adjusting parameters and evaluating their effectiveness over time.

- Real-Time Alerts and Notifications: Technical analysis software provides real-time alerts and notifications to traders, alerting them when specific technical conditions are met. These alerts can be customized based on individual preferences and trading strategies, ensuring that traders stay informed and can act swiftly in response to market movements.

- Integration with Market News and Events: Some technical analysis platforms integrate with news feeds and economic calendars, providing traders with additional context and insights into market developments. By staying informed about relevant news and events, traders can better understand the factors influencing market movements and adjust their strategies accordingly.

In summary, technical analysis software functions as a powerful tool for traders in the Indian stock market, offering advanced features for analyzing market data, identifying trading opportunities, and executing trades with precision. By leveraging historical data, advanced charting capabilities, and a wide range of technical indicators, these platforms empower traders to make well-informed decisions and navigate the complexities of the stock market with confidence.

Conclusion:

In the Indian stock market, where market dynamics can be influenced by various domestic and international factors, technical analysis software provides a valuable edge. By leveraging these tools, traders can enhance their market insights, improve decision-making, and potentially achieve better trading outcomes. As technology continues to evolve, the capabilities of technical analysis software are likely to expand, offering even more sophisticated tools for market analysis and strategy development.

Technical analysis software Functions in the Indian Stock Market plays a vital role in the Indian stock market, offering traders sophisticated tools to analyze market data and make informed decisions. By aggregating vast amounts of historical market data from sources like the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), these software solutions provide comprehensive insights into price movements and trading volumes.